Rising Rates Effect on Vancouver Real Estate March 2021

Rising Rates Effect On Vancouver Real Estate: March

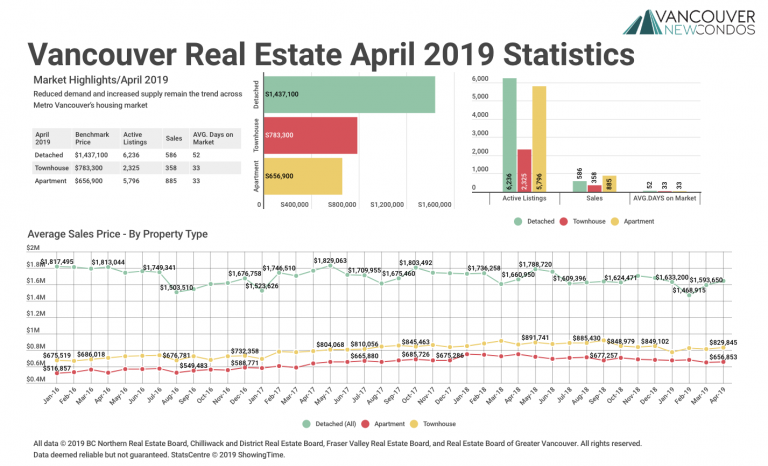

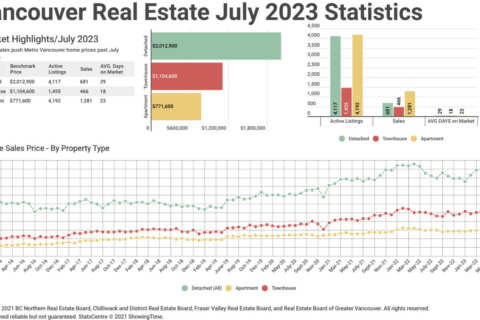

Vancouver real estate listings in February were up 56% from the previous month, which is 73.3% higher than the same time last year. Analysts predict that prices will go down when the sales to active listing ratio goes below 12%. When the ratio is above 20%, it signals prices will go up. In December 2020, we were at 35.2% for detached homes, 50.4% for townhomes, and 33.1% for condos. In January of this year, we had a lot more product come on the market and were at 26.3% for detached homes, 37.6% for townhomes, and 27.8% for condos. In February we went back up to 41.8% for detached homes, 61.8% for townhomes, and 41.7% for condos.

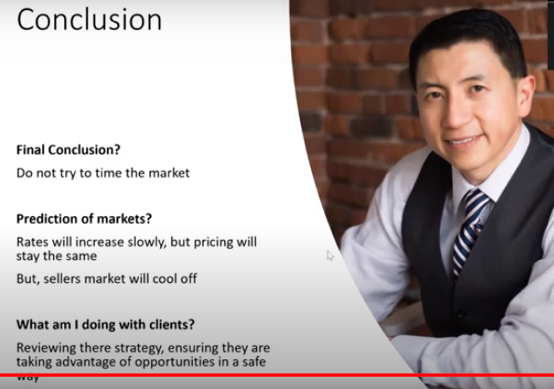

What does this mean according to the analysts? Sales prices are trending up since all of these numbers are over 20%. It’s like trying to turn a boat around – it won’t correct quickly, the momentum keeps going upward. We feel prices will continue to go up in 2021.

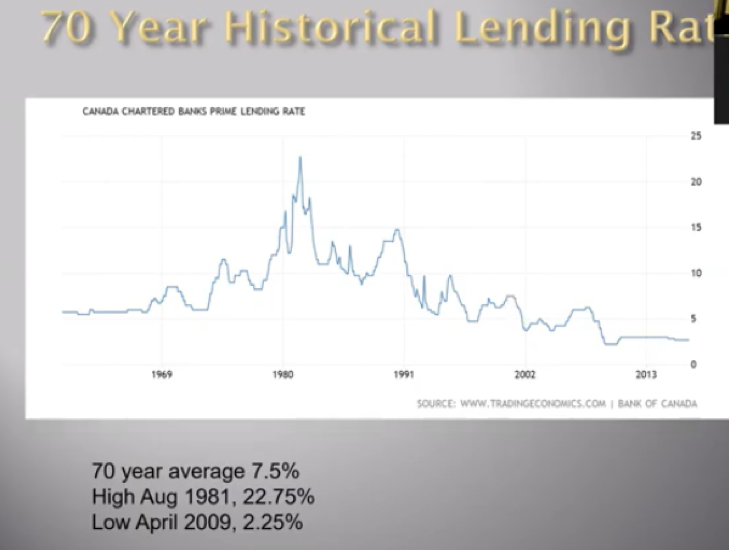

What about mortgage rates? If you take a look at the chart, the crazy ‘80s rates were in the low 20-percents. They were at 18% for a while and then for a short time the historical largest rate at 22.75%. What happened in the years when mortgage rates went up progressively? Did it slow down the real estate market? Yes, but only for a short time. That’s what we believe will happen again. If there is a slowdown, I don’t think prices will be negatively affected, unless we see data showing that. Of course, we use data such as sales to active listings. That’s what guides us to see which direction prices will go.

If we look at the rate trends, in several places of the analysis, including speaking with people who were around for this in the ‘80s, when lending rates went up, people actually started to buy more. Why would people do this? They didn’t have a crystal ball to know what would happen the next year. Newspapers said rates could go as high as 28-30% and if you didn’t buy now, you could miss the boat and never be able to afford a house.

Let’s play that out in today’s market: interest rates are at about 1.6-1.7%. Let’s say interest rates are on their way up and might land at 2% or even 2.5%. If you’re looking for a property, is that going to motivate you to get into or stay out of the market? If you knew that you only had a year left with rates of under 2%, you’re going to run out and buy a property. But, it’s supply and demand – now we have too much demand, so what will it do to prices? It will push them up.

I agree. The reason why historical rates were so high back then is that there was excess demand in the economy. It was booming. In the early 1980s, when Paul Volcker was head of the Federal Reserve, he raised rates that high to cool the economy down. So, now what we’re seeing with this slight uptick in super low rates right now is just an indication that the economy is starting to come back, and quite frankly I don’t see it as that bad of a thing at all. It’s quite normal. The reason why interest rates are going up is that the bond market, which is what controls variable rates in Canada, has indicated they anticipate accelerated economic growth and good times ahead. When you have a good, growing economy and a demand for money, that pushes up the interest rate.

What we’re seeing in the market is crazy. For most types of properties, with few exceptions, there’s excess demand and not enough supply. Single-family houses under $1.5 million are just crazy. We’re seeing price increases now, but I think over the next few months we’ll see even more dramatic increases. Using statistics to see what’s happening in the market is kind of like driving a car with the windshield painted black while you look in the rearview mirror, but we’re seeing upward pressure on prices right now.

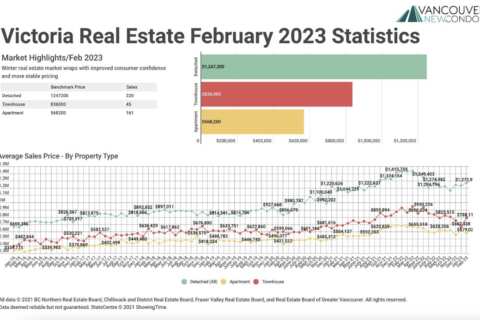

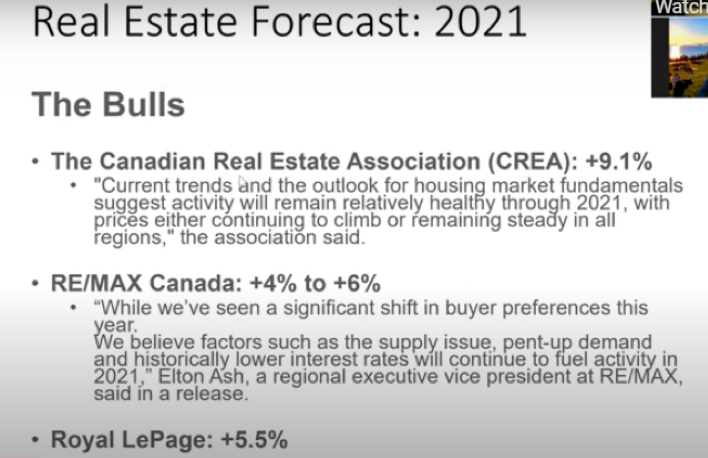

I don’t see anything slowing down. If we take a look at the real estate forecast for 2021, the Canadian Real Estate Association predicts +9.1% in prices across Canada. RE/MAX products +4-6% and Royal LePage predicts +5.5%.

]

]

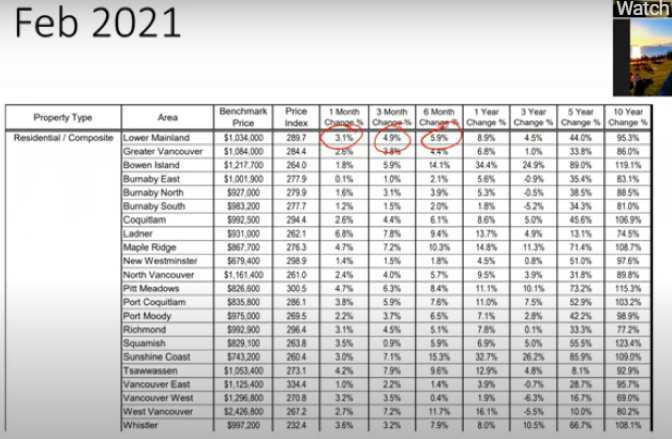

Just in the past month, there’s been a 3.1% increase in the Lower Mainland and a 4.9% change in the past three months. In the past six months, there was a 6% change. Every number is positive; we’re trending upward.

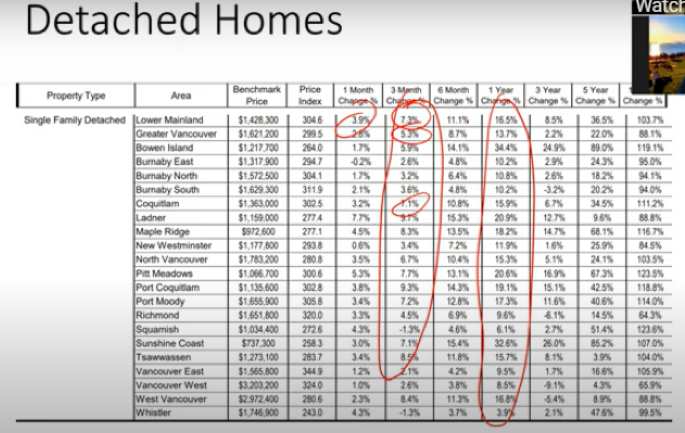

If you dissect this and just look at houses, the one-month change was 3.9%. The three-month change, just since November, is incredible: Coquitlam was 7.1%, Vancouver was 5.3%, Lower Mainland was 7.3% – we are heavily trending up. The one-year percentage change is in double digits across the board. You can get that entry-level house, a step up from a townhouse or condo, in the low one-millions – they will be on fire. There’s too little supply, too much demand, people holding onto 1.5-1.6% interest rates only good for a few months or so who are anxious to buy, or they’ve sold and have to buy to close their sale so they’re very motivated.

Or, they may have sold and are sitting on cash in a rising real estate market – every time real estate prices rise, it shrinks the purchasing power of the cash you have. That’s another thing to consider.

You also have people who have sold and are kind of homeless. They’re living in parents’ basements, a short-term rental or Airbnb. They thought they’d be doing that for a month, but maybe it’s been three months and they’re dying to get out of there.

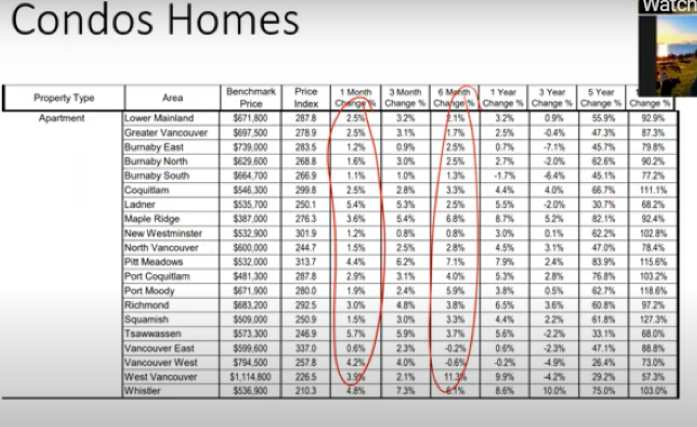

Last time, we said condos weren’t so hot and I’d still say the same. Numbers in the one-month and six-month change are slowly trending up.

If you compare what’s happening with houses to condos in some areas, especially expensive, high-end, for example at Boundary Road and east and in North Vancouver, you could say they’re a bit soft. We’re not seeing multiple offer situations and if sales occur for condos, we’re seeing buyers able to negotiate a bit. I’d say that’s related to the hangover from COVID and the fact that a lot of people still don’t feel comfortable being in a condo and common, shared areas like lobbies. But, give it three to nine months and the condo market will explode too because the Bank of Canada said they’ll keep rates low in the form of quantitative easing – they won’t raise rates.

I feel the same. I think rates will go up a bit, but they could even go down. In 2018, rates went up by a quarter-point three times in 12 months – we thought that was it and we’re going back to rates at 4-6%. But, what happened was rates stayed in the low twos for years. They crept up and up and then no one predicted it, but they went back down.

What will the rising rates do to purchasing power?

Rising rates do have a negative impact on purchasing power, but I don’t think the rises we’ll see in the next two years will be significant enough to damage it. Right now, we’ve got a hyperfocus on real estate, mortgages, investment, primary residence, multiple offer situations. But, if you step back and look at the overall economy of Canada and the US, we’re still coming out of the COVID-19 crisis. They shut down our economies for 3-9 months and there are still ongoing lockdowns and other things that have a big impact on the economy. The North American and other major advanced economies cannot handle high interest rates – they’ll go into recession. I would argue that central banks and national governments across the world will continue to have accommodated monetary policy – meaning very low interest rates, printing money and introducing stimulus. For example, Joe Biden’s $1.9 trillion stimulus package passed this year. So, of course, that will put upward pressure on demand and interest rates. But the Federal Reserve, the European Central Bank, and the Bank of Canada will keep printing money which pushes down long-term interest rates. Rates may be going up now but they’ll go back down. Look at the stock markets: when interest rates went up, the stock market went down. For example, Tesla went up 20% yesterday because the Federal Reserve and other banks said they will be keeping interest rates low. Rates won’t rise dramatically until at least 2022-2023. It slows the economy dramatically and governments who want to be re-elected won’t be, even though central banks are independent. They’re not here to stop the economy; they’re here to support and keep the economy going, and real estate is a huge part of the overall economies of Canada and the US.

I had clients that were quoted on a 10-year fixed rate at under 3%. The banks aren’t stupid – they’re not going to give out 10 years at 2.5% if they thought rates were going up; they’d lose a lot of money. I think rates will stay low but, naturally, they go up a little bit – but it’s about how people will react when they go up.

That’s the thing. If you step into the bank’s shoes, the mortgage is an investment in you and the property. If they loan you $500,000 for 10 years at 2% and inflation hits 2% or more next year, they’re losing money. Banks are not in the business of losing money; they make money. So if they’re willing to offer such a low rate for so long, I think they have a pretty good idea that rates won’t go up.

Also, if we look at the overall economy before COVID-19 hit, we were dealing with low inflation. So, you’ll see central banks and national governments wanting to increase inflation. If you get a locked-in mortgage at under 2% and the Bank of Canada’s and Federal Reserve’s target for inflation (as they’ve recently hinted at) is 2%, the bank is effectively paying you for the use of that money. But if inflation picks up and your interest rate is a bit higher, it’s not that bad because the amount of debts goes down by the inflation rate.

Is it a good time to invest in a condo right now since there’s not much overbidding and prices are slowly creeping back up? What will the rental situation be like for the rest of the year?

For full disclosure, I should be completing on an assignment condo I bought in East Vancouver in April, and the reason why I bought it is, first and foremost, the rates are the lowest I’ve ever seen. I want to take the money I’ve saved and invest it somewhere. The condo is worth about $500,000, I’m putting $120,000 down, I’m getting a five-year fixed-rate mortgage at about 1.65%. In terms of the principal, it will pay down $10,000 per year, or a 10% return on investment per year regardless of whether prices go up or down. The other thing I like about this is that if inflation does go up, it will affect the price of real estate by pushing it up – real estate is the best investment if you’re concerned about inflation – and it will increase rent.

When I work with my clients, I avoid focusing on if a price is high or low. I do the analysis by entering the price, the rent, the vacancy, the down payment, and the mortgage rate and then seeing if it will break even or cash flow positively or negatively. So, even if you have to bid $5000 over asking to get a place, you should still check to see if it cash flows and makes sense with your criteria. Don’t assume it’s a bad idea. You need to dig a bit deeper with someone like Mike or myself – the quick answer to “is it a good idea to buy a two-bedroom condo in downtown Vancouver?” is maybe. We’d have to see all the other pieces first.

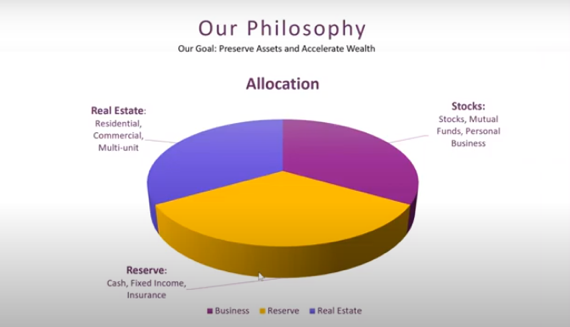

Yes – it depends on your personal financial situation. A guy like Christian can look at your finances and recommend what to do or not do based on what you’ve got, what’s tax-efficient, best for your retirement, your family situation, etc. Then, come talk to me and I’ll show you the options that work best for your personal financial situation. Everyone’s employment, financial, tax, and lifestyle situation is different. We help with customized plans specific to individuals.

In the current environment, what and where is the hottest, in-demand sellers’ market product?

Single-family houses east of Boundary Road to Hope, the North Shore, Okanagan, and southern Vancouver Island, along with single-family houses south of the Fraser River – or basically across Greater Vancouver – under $2.5 million are just on fire. Big price appreciation coming in the next few months.

So, someone coming in now that wants one of these must come in subject-free and over-bid – how much do they have to go over to get one?

It’s anybody’s guess. Talk to someone like Christian, talk to your accountant about the tax perspective, then, most importantly, talk to your mortgage broker so you know exactly what you can spend before you go shopping. You need this information in advance because, in multiple offer situations, the whole process is backwards – you do your inspection and send information to your mortgage broker before you write the offer so that it can be clean when presented. Going subject-free on a property is risky, but you can hedge and mitigate that risk by doing your due diligence in detail before submitting your offer. That’s the key in a market like this – be prepared, have everything done and ready before you shop.

Also, this can make your offer a lot more powerful and get you a deal if you’re operating in markets that aren’t as hot as single-family houses in the mentioned areas. Maybe you’re looking for a condo in downtown Vancouver and find a property that’s been on the market for 150 days and the seller is motivated. If you go to them with a subject-free offer and a deposit, they’ll take you more seriously at a lower price than they would someone who offers 10% below asking but needs two weeks to get their stuff done.

The part I play with clients is, let’s say they’re trying to buy something for $1.3 million and the mortgage broker says they can go to $1.4 million, so they go for that, but then I look at their plan and see they want to have a kid within 2-3 years. At that point, they’ll have one income or pay for daycare for 4-5 years and are paying for real estate $100,000 over asking that they could barely afford already on a 1.6% interest mortgage, but if it renews at 2.2-2.5% they could be in trouble. That’s where financial planning is needed – people get so caught up in buying the house that they don’t think about whether they can afford it in 3 or 5 years.

Safety first – you never want to have surprises. Working with advisors means you won’t have them or buy anything you can’t afford.

Let’s say you qualify for a 1.6-1.7% mortgage and rates go up to 2% before you’ve bought anything. What will this do to housing prices in 3-4 months when people are in this situation?

First of all, I don’t think we’ll see that kind of interest rate appreciation. But I think it will take the market from being red hot crazy to just red hot. I’ve been doing this for 15 years and have seen three big run-ups in prices. The first two, interest rates were at 4-5% – much higher than right now. You can have a surging real estate market with much higher rates, and here’s why. The longest amortization you can get on a property is 30 years, most being 25 years. When I started in 2005, you could get a 40-year amortization. A 35 or 40-year amortization dramatically increases a buyer’s purchasing power as it dramatically reduces payments (while increasing interest costs).

For investors, this is good, because most of the payment is for interest which gives you a bigger tax deduction on the revenue coming in from that property. The Department of Finance can see rates rising and be concerned it’s causing real estate to go down, so they can increase amortizations. This dramatically increases affordability and keeps the real estate market going. The government uses the real estate market to boost the Canadian economy – they did it in 2008-2009 and they’re doing it now. The Bank of Canada said they will keep policies accommodative, meaning they’ll keep the prime rate low and will continue to print money. Right now, they’re printing $4 billion every week! If the interest rates get forced up because of the bond market, they’ll just push out amortizations. We need low interest rates though since we’re coming out of COVID.

Is there any area or product in the Lower Mainland you feel are good buys, not crazy red hot or competition with a million people?

Yaletown and downtown Vancouver, anything $2-2.5 million and over either one or two bedrooms. Also, two bedrooms in North Vancouver are relatively soft. There are pockets where the market isn’t that crazy and I’d argue a lot of that softness in the condo market is a holdover from COVID-19. The reason why everyone wants single-family houses is that they’re hot and people are still concerned about COVID. But once that mass vaccination happens and borders open, I think the market will surge, particularly condos.

Up until COVID-19, we had 350,000 new people coming to Canada each year. In 2020, it was only 187,000 people. Right now, Immigration Canada and the federal government are doing everything they can to get people in the immigration system fast-tracked so they can become permanent residents and citizens. Before COVID, the government wanted to bring in 400,000 people but they didn’t make it. Now, there will be a huge amount of people coming in as immigrants, foreign students and visitors. This will create massive demand for condos because when people are new to the country, where do they go? As tourists, where do they go? Downtown Vancouver, downtown Victoria, Kelowna. They’re simple, easy to understand, walkable areas. So, I think that condos in the cores of cities are a fantastic buy and if you do so, you’ll be extremely happy with your investment when the borders open

Prediction for interest rates in Vancouver

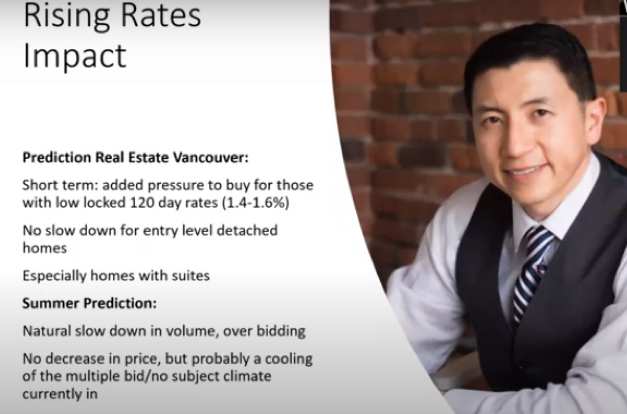

In the short-term, there will be added pressure to buy for those with low, locked-in 120-day rates in the low to mid-ones. There won’t be a slowdown for entry-level detached homes, especially for those with suites. People need that mortgage helper when they move from condo to house.

In the summer, there will be a natural slowdown in volume and overbidding when people don’t really want to sell and wait for the fall.

I don’t think there will be a decrease in prices – there’s no indicator of this that I’ve seen based on my analysis. But, there will be a cooling of the multiple bid and subject-free climate we’re in now.

I don’t necessarily agree. In my experience, you see a massive run-up of prices and they plateau at a higher level whereas sellers won’t negotiate as much because they know things can pop off again. So, I think we’ll still see this craziness and price rises going into the summer. Many people I know in the industry feel that once the border opens up, we’ll see a 25% increase in prices across the board. There’s a lot of pent up demand from people throughout Canada or who are Canadian citizens outside of Canada just waiting to buy in BC.

Well, we can both agree that there’s no way prices are going down.