Real Estate Outlook Vancouver 2021 – January Webinar

Forecast

Real estate

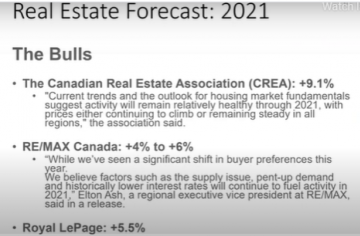

There are two camps for the 2021 forecast: the bulls and the bears. For the bulls, CREA says we should go up by 9.1%, RE/MAX says 4-6%, and Royal LePage says 5.5%. These estimates are based on different housing trend factors. The bears are pessimistic: RBC and Scotiabank think it will be flat, Fitch Ratings believes we’ll decline by 3-5%, and CMHC thinks it will be 9-18%. This was also their stance for the prior year, which they were wrong about.

All of this to tell you that it’s confusing! First off, these stats are based on all of Canada. Vancouver is such a unique market, so I’d be very careful about painting the country as one whole.

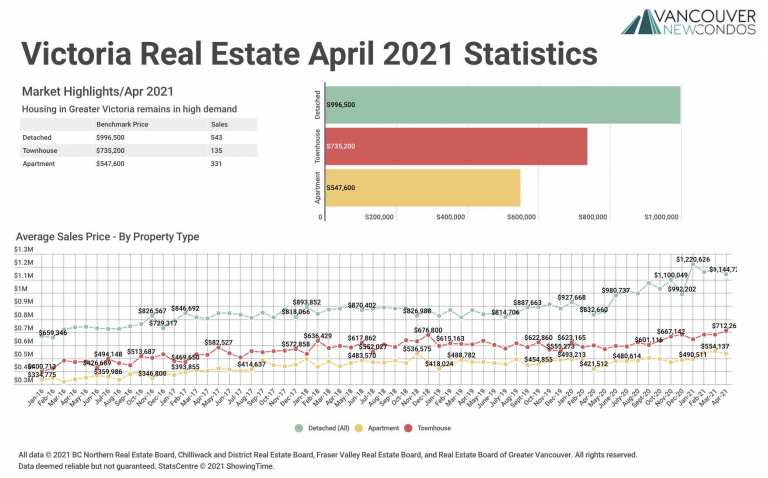

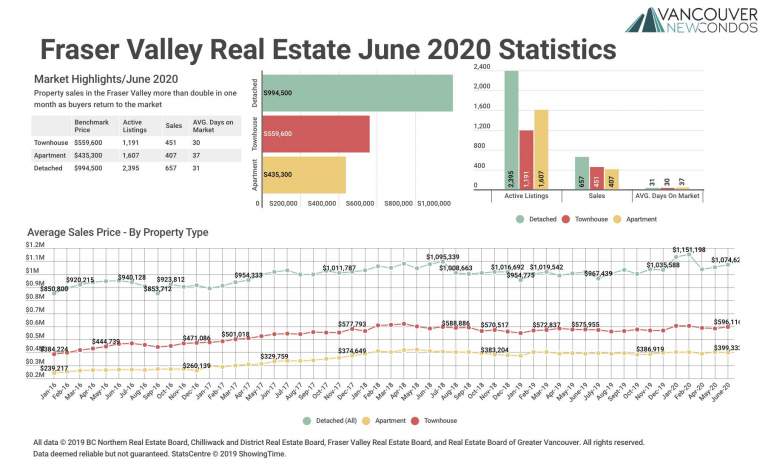

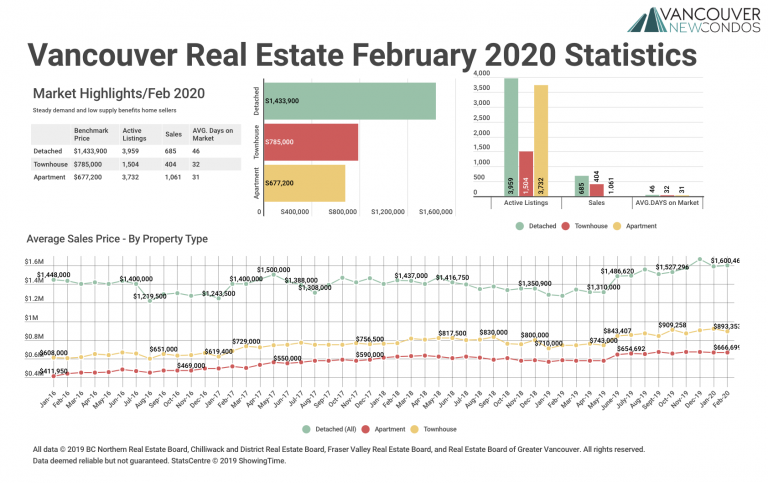

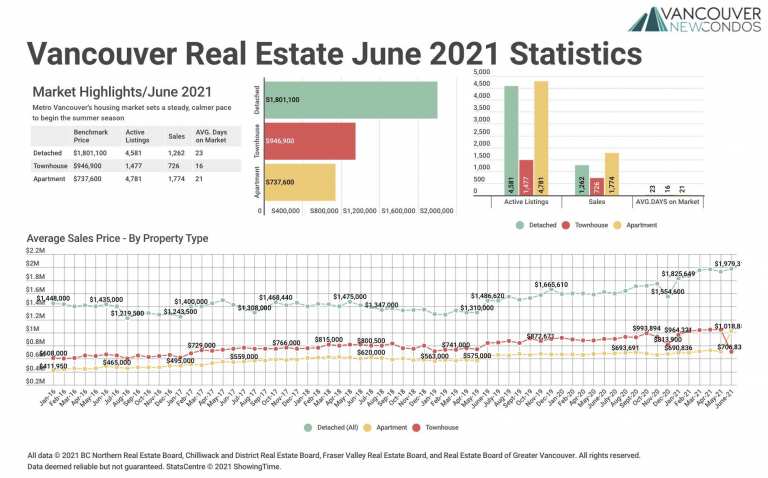

So, let’s look at Vancouver real estate: December sales were up 22.1% from the same time in 2019 – typically, people don’t buy and sell a lot in December but because of the pent-up demand it was high in December.

Analysts believe when you have a sales-to-active-listing ratio below 12, you get downward pressure. When it’s about 12, you have upward pressure.

- Last month, we were at 27.9% for detached homes, 40.1% for townhomes, and 23.9% for condos.

- Now, we’re at 35.2% for detached homes, 50.4% for townhomes, and 33.1% for condos.

So, not only are we significantly above the 12% mark, we’re trending upward. In my view, in 2021, we’ll see the real estate market in the Greater Vancouver area continue to rise.

Stock market update

As an investor, should we put our money in stocks or real estate? I invest in both. We are back to pre-covid stock market levels. There was an amazing opportunity last year – all of the easy money was if you invested new money during the March-April crash. Tom Lee of Fundstrat believes there will be a cooling-off because we went up so quickly in Q1 but then there might be a pullback by the end of the year when the vaccine is fully rolled out and the economy is back up and going. There is opportunity in the stock market, but there will be volatility. So, personally, I’m looking at real estate.

What is happening on the front lines of real estate in the Greater Vancouver area?

It’s starting to get really busy. Single-family houses in East Vancouver are extremely hot and in high demand. Houses are getting anywhere from 10-20 offers in some cases. Larger, ground-oriented townhouse options are doing extremely well. I was looking at a small duplex in Strathcona listed at $1.19 million that sold for $1.425 million, and its lower-level unit listed for $899,000 sold for $1.185 million.

We’re seeing significant demand and upward pressure on prices. This goes back to what we were talking about with the sales ratio – when you have an elevated ratio above 12% for an extended period, you start to see prices increase. I would argue this is caused by the extremely low interest rates. We’re seeing variable rates for insured mortgages (those where you put down less than 20%) at 0.99%. For non-insured mortgages, where people put down more than 20%, we’re seeing 1.39%. I’m personally investing in property and am getting quotes of 1.59-1.69% for five-year fixed mortgages. This is fantastically low. If we see inflation get to the Bank of Canada’s target of under 2% and you have a 1.59% mortgage, you’re literally being paid by the big banks or your mortgage lender for borrowing that money.

Things are very active. Downtown Vancouver, as I mentioned last time, was quite soft mid- to late-last year, but it’s perking up now and we’re seeing a lot of demand. I just relisted two listings that were very quiet last year, one with no showings, and now offers are coming in and many more showings. Things are starting to perk up in the downtown core. Single-family houses in North Vancouver are extremely active. I think we’ll see a broad surge in demand for all property types because we have these extremely low interest rates.

As the vaccine gets rolled out, we’ll get away from what I term the “90% economy” we’re in right now, where people in foodservice, travel, and other industries aren’t working and making income, to an economy where people in large numbers are going out to restaurants and bars and travelling, as they get more comfortable. We’ll then see an uptick in demand for rental units which will push up rents and make investments people are making now in rental properties look very wise. Rents have come down in downtown Vancouver across the region during COVID as people move away from smaller units because they feel uncomfortable in high-density, crowded places – younger people are moving home with their families and people are moving into larger spaces further out. But I think this will reverse.

If you look at what’s been happening with the stock market before the vaccine announcement, many stocks were way down, like oil and airlines, and all these remote working stocks were way up. As soon as they announced a credible vaccine, we saw a surge in these stocks because we’re going to get back to the way we were and things will be okay. Once we see the vaccine distributed, the economy will start booming. We’ve got ultra-low interest rates. The economy and real estate markets were doing really well before COVID-19, and the Bank of Canada and the federal government have both signalled they will allow the monetary and fiscal stimulus to continue well after we’re vaccinated because we have to make up for lost GDP. I think those who invest now will do quite well going forward, and I’m extremely optimistic about the market going forward.

I echo this. You know that I’m also looking for real estate right now, as are my family members and clients, and what I’m finding is they’re having trouble finding product. There seems to be a supply shortage, and when you pair that with heavy demand, you get upward pressure on prices. I know multiple people who put in asking or above-asking offers in certain areas and were outbid.

I’m looking at properties that are at 2017 pricing or less. We’re almost at five years, an economic cycle, so what are the chances we’ll see certain products back to their 2017 levels? In 2025, eight years from those prices, the chances are pretty high. But it might be one year or six months from now. I think we’re in a window of opportunity, especially for the buyer who might not have been able to afford 2017 prices at 2.28% interest. Now, same pricing in 2021 at 1.6% on five-year fixed, and that same person probably earns more income now. Across the board, I think people will realize this and it’ll cause upward pressure.

I agree. You make a good point – 2017 was a banner year for real estate in Vancouver. A lot of that was to do with money coming in from overseas, but interest rates were a lot higher then. Now, one of the biggest drivers of real estate, immigration, is on hold. As well, foreign students support a lot of revenue properties and furnished rentals. So, we’re seeing this upward pressure on price but we don’t have the components of demand for Vancouver real estate. As well, not many properties in the city are cash-flowing, but I’ve been looking with a close real estate colleague of mine in the Okanagan and Alberta – both have cash-flowing properties (the only concern with Alberta is the future of oil).

I agree. You also need to be careful of vacancy in Alberta.

In this report, I wanted to highlight some things.

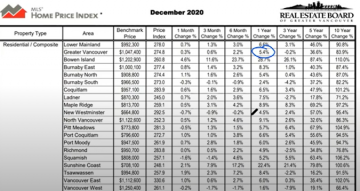

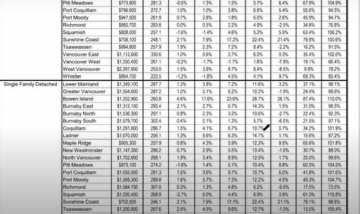

The one-year change in Greater Vancouver is 5.4%. But, when you dissect by area and property type, I notice many are in the double digits! Coquitlam,10.7%, Bowen Island, 28.7%, Sunshine Coast, 22.4%.

These are the areas we identified before, where people are moving during COVID because they feel secure.

Yes. and if you look at the 10-year returns, they’re high at 6-7% ROI year-over-year for 10 years. Remember, your home is a capital gains tax-free investment.

For condos and townhouses, the numbers are in the single digits or even slightly negative. So, I’m feeling like the detached home is a hot commodity right now – there’s low supply but high demand.

Absolutely. They’re not making any more single-family houses or lots – if anything, supply is constricted. Anytime a new condo building goes up or a new duplex is built, they’re made of single-family house lots. We see the price of condos going down because of COVID; I would argue this is the time to buy that type of product if you’re an investor. As an investor, don’t look at the things that are up now; look at the things that are down. In future, what’s down will come up. Right now, that’s condos.

I live in the type of house that’s in very low supply and high demand, and right now I’m exploring listings with lower than 2017 prices – I want some discounts on the upgrade. If you can afford it, with these low rates, it’s not a bad strategy.

This brings me to my next point. Should I be making a move in real estate? My philosophy is that money always increases when it’s in three buckets:

- The stock market

- The real estate market – all of my clients love real estate which is why they gravitate to me as opposed to a traditional advisor. I like to encourage people to buy real estate, whether it’s through a holding company, personally owned, residential, commercial or multi-unit.

- Cash or fixed-income reserve to capitalize when there’s an opportunity

Here’s a typical client of mine:

- Newlyweds, looking for a financial advisor beyond what the big banks offer

- Each owns a condo and earns a good income

- They want to start a family and upgrade their home

- Options are to:

- Sell both and upgrade,

- Keep both as rentals and save up for a down payment on an upgraded home, or

- Keep one as a rental and sell the other for a down payment, but which one?

Many financial planners don’t do the analysis that’s required to properly answer these big questions.

Latitude West would have a discovery meeting to find out what you’re trying to do, navigate different options, then implement the strategy. Then we do a competitive analysis to compare the two homes and see what the net advantage is. We do this with investment and personal properties.

We can show what retirement looks like for two or three properties on the revenue side.

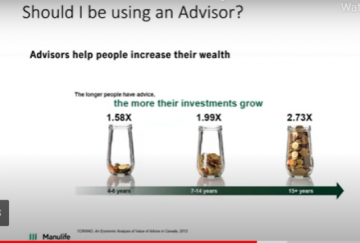

People should be using an advisor when they can’t do things themselves, but they should be the right advisor – someone using real estate if that’s what you want to do.

Don’t try to time the market. I think that rates will stay very low and demand for real estate will be high. How does this integrate with your stock portfolio or other investments? That’s where I can help. I review my clients’ strategies to ensure they’re taking advantage of opportunities in a safe way.

Questions

Can you talk about the potential disparity between condos and single-detacheds in terms of 2021 predictions?

My crystal ball is as good as yours, but I personally think that overall you’ll see demand across the board for everything. I think single-family houses will continue to be in extremely high demand and you’ll see price appreciation, particularly in areas with good schools and lower prices. Condos may go up faster than single-family houses because you’ll see a lot of demand from renters, and I think rents may start going up later this year. This could make condos a lot more attractive. As people get vaccinated and become more comfortable living in urban areas because, up until COVID, people were leaving single-family houses and the suburbs. This will continue because many people these days aren’t having kids or getting married and want to live a single life, which, I’d argue, isn’t as good in the suburbs as it is in the core. Condo prices might catch up with the gains of single-family houses. Before the foreign buyers’ tax, single-family house appreciation was significantly higher than that of condos and after the tax, that switched because there wasn’t as much overseas money going into higher-priced single-family houses. Condos are very much designed for and affordable to the local market. It’ll be interesting to see what happens after COVID – single-family houses will always be in demand because their supply is constricting, but I think condos will do quite well.

Do you see adding a laneway home to your property a benefit still, or will the regulations cause problems?

Adding a laneway home is a fantastic return on investment. The key though is to look at the lot you have, what the zoning is and what’s allowed. But, if you can build a revenue property for $250,000 that pays you $1,800-2,500 per month, you’re in a great situation. Let’s say you earn $2,000 per month for a year, or $24,000. To get the cap rate, you divide that by the cost of investment, or $250,000 in this case. That’s a 9.6% gross return, and in my view anything over 5-6% in Vancouver is fantastic because it’s so rare. If you can build a laneway home in a cost effective way, I would do it.

What allocation should go into real estate, stocks, and reserves?

This isn’t an easy question to answer because everyone is different depending on their stage of life and how much real estate they already own. One example to look at is the Canadian Pension Plan. if you look to see what you make off this as a ROI, it’s very high. They have many money manager professionals because they have to pay out CPP when we retire. They have 22% in reserve cash, 34% in some form of real estate assets, and the remaining 44% in equities. Another example to look at is the Tiger 21 – these people are the richest investors in the world. You need a $10 million minimum investment to be part of this group, which is like a club. The average person in it is worth $100 million. They publish where they’ve invested their money: they have about 35% in real estate, 20% in accessible cash, and 45% in equities. Now, I wouldn’t say keeping 20-25% in cash is a good idea in this environment right now. The important part is being able to access the money without selling the stocks or real estate. My personal setup, being a real estate guy, is having a larger real estate portfolio than stock portfolio, but I have access to about 20% of my whole portfolio if I needed it.

What effect will the federal foreigner tax, to be applied from spring 2021, have?

I don’t think it will have any effect in BC because we already have the foreign buyers’ tax. It will be bad for places like Alberta and the Maritimes, where Europeans buy vacation homes. It’s a political fig leaf on the part of the current government to hide the fact they’re no longer doing anything on housing affordability. They’re using the real estate market as a safety balloon to keep the Canadian economy from sinking. They’re doing this by dramatically cutting interest rates, as they did in 2008-2009, which causes the real estate market to surge. This increases tax receipts but it also, more importantly, creates massive stimulus in the Canadian economy and keeps it from going into a deflationary spiral. It won’t be impactful – it’s a political nothing to help get the Liberals re-elected.

Is a studio in the downtown core a good investment?

Absolutely. I like studios a lot and you can get great revenue from them, particularly if they’re furnished. But, you have to buy in the right building and it needs to be good quality. A lot of buildings in downtown Vancouver are showing their age, and you see these listed on Realtor.ca. A lot of them are junk and have serious insurance deductible issues. One particular building I won’t name has many small and one-bedroom units, and it’s one of the few that allows short-term rentals. The insurance deductible is $750,000. So, if you own a property there worth, say, $600,000, you don’t have the right insurance, and your tenant causes a leak that’s $749,000 worth of damage, you are personally responsible for this. So, be very, very careful when buying an investment property and make sure you have a realtor who knows how to steer you right. If you do it wrong and have an insurance claim, the deductibles can be a catastrophic loss. Many of these buildings have a $250,000 water damage deductible, and I think you’ll see many more getting them. Another issue with these buildings that are 20-25 years old is the building envelope – major work comes up. You might get a cheap unit for good rent, but your investment pro forma will be completely blown up if in year two of ownership the strata says they need $30,000 or $50,000 to do the building envelope or parking membranes.